AMD (NASDAQ:AMD) has emerged as the biggest winner from Intel’s (NASDAQ:INTC) massive cock-up yesterday, further cementing its status of a rising challenger. As an illustration, AMD shares are up 16.27 percent, trading at $69.26 price level, as of 14:50 ET. Should AMD manage to close near this point, it will have formed a fresh all-time high.

So, how did AMD receive such a boost? The saga began yesterday when Intel revealed as part of its Q2 2020 earnings:

“The company’s 7nm-based CPU product timing is shifting approximately six months relative to prior expectations. The primary driver is the yield of Intel’s 7nm process, which based on recent data, is now trending approximately twelve months behind the company’s internal target.”

Even though Intel’s financial performance was solid during the quarter, the repercussions of this announcement went far and wide. Intel shares plummeted over 9 percent in the after-hours trading. Today, the stock is down another 16 percent, currently trading at $50.68 price level.

A number of analyst pronouncements since yesterday have been adding to Intel’s gloom and AMD’s euphoria. For instance, Bernstein analyst Stacy Rasgon noted that intel’s earnings call was the “worst we have seen”, bringing the company’s structural issues to the forefront. Moreover, Raymond Jones analyst, Christopher Caso, said:

“Moore’s Law doesn’t wait for Intel.”

Caso further added that the news will be viewed as a positive for AMD as it will now have a transitory advantage for the next 3 years.

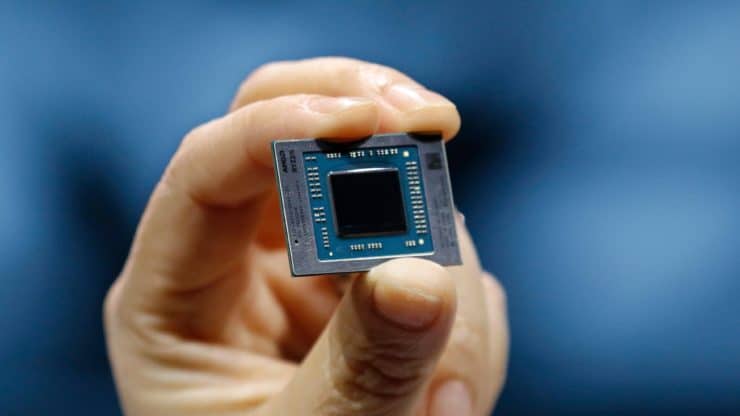

In this backdrop, AMD is shining brighter than ever. Earlier in July, the company announced the Ryzen 4000 desktop processors based on the 7nm Zen 2 architecture with built-in Radeon graphics. AMD’s press release noted that the Ryzen 4700G Desktop Processor offers:

- Up to 2.5X multi-threaded performance compared to the previous generation

- Up to 5% greater single-thread performance than the Intel Core i7-9700

- Up to 31% greater multithreaded performance than the Intel Core i7-9700

- Up to 202% better graphics performance than the Intel Core i7-9700

Moreover, the anticipated launch of the company’s Big Navi GPU later this year is also adding to the investor euphoria. As an illustration, Cowen Inc. cited this development earlier in July as the foundational construct for a stock price target hike from $60 to $65. Cowen analyst Matthew Ramsay praised AMD’s strong and predictable product execution – now consisting of “Milan launch, Big Navi launch, Genoa design closure, 6nm timelines” – as well as server revenue growth, constituting “the most important LT [long-term] revenue sticks”.

Given the emerging paradigm, unless Intel manages to stage a surprise comeback, AMD can expect smooth sailing ahead.

More Stories

EKWB Unveils The Quantum Vector FE RTX 3080 D-RGB – Special Edition Blocks For GeForce RTX 3080 FE Graphics Card

AMD Ryzen 7 5800H 8 Core & 16 Thread Cezanne ‘Zen 3’ High-Performance CPU Shows Up, Early ES Chip With 3.2 GHz Clocks

AMD Ryzen 9 5950X 16 Core Flagship CPU Benchmarked Again, Crushes Intel’s Top Core i9-10980XE 18 Core HEDT Chip