AMD (NASDAQ:AMD), a major player in the semiconductor sphere, is gearing up to acquire Xilinx (NASDAQ:XLNX) for $30 billion, thereby, providing an impetus to the ongoing consolidation wave in the industry.

According to the sources quoted by Wall Street Journal, AMD and Xilinx are currently in an advanced stage of negotiation, with a potential deal emerging as early as next week.

Bear in mind that Xilinx manufactures programmable chips for wireless networks and its acquisition will provide AMD a solid foothold in an industry that is currently in flux. With carriers injecting billions of dollars in the telecommunication sphere in order to expand the coverage of the next-gen 5G wireless network, Xilinx has become an important node in this endeavor.

Of course, this move by AMD may also be a shot across the bow of NVIDIA (NASDAQ:NVDA). As an illustration, the GPU-focused semiconductor giant has been on an acquisition spree of its own lately. Back in September, NVIDIA entered into a definitive agreement with the Japanese behemoth, SoftBank, to acquire ARM for $40 billion. As a refresher, ARM designs silicon chips and licenses instruction sets that govern how chips communicate. Moreover, ARM’s intellectual property – including the company’s Reduced Instruction Set Computing (RISC) Instruction Set Architecture (ISA) – is utilized by Apple, Qualcomm, Samsung, Huawei, etc. for their smartphone chips, thereby, corresponding to a market coverage of around 90 percent. Additionally, NVIDIA closed its acquisition of Mellanox earlier this year, creating a viable avenue in the process to optimize its data center-based computing and cloud solutions. Mellanox has pioneered the InfiniBand interconnect technology, which in conjunction with its high-speed Ethernet products, is employed in over half of the world’s fastest supercomputers and multiple leading hyper-scale datacenters.

The acquisition of Xilinx will also allow AMD to better compete against Intel’s (NASDAQ:INTC) sizable footprint in the data-center sphere. Moreover, the FPGAs produced by Xilinx will allow AMD to expand into the rapidly growing AI and networking segments, bolstering the company’s portfolio breadth.

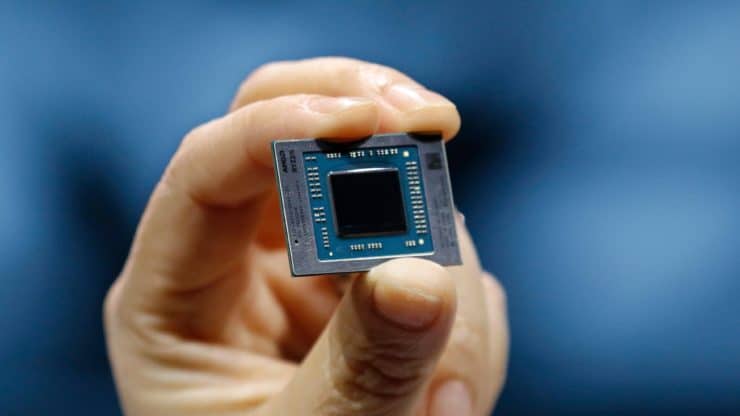

This development comes as AMD unveiled the new Ryzen 5000 series processors, based on the Zen 3 microarchitecture, on the 8th of October. We noted in our dedicated coverage yesterday:

“The AMD Ryzen 5000 is highly anticipated because not only will it exceed the performance of the Zen 2 based processors, but Zen 3 is expected to deliver some major improvements in terms of IPC and also gaming performance, representing far better perf/$ values than the competition who have also announced their Zen 3 competitor but doesn’t launch until Q1 2021. Given how AMD has clawed away major share and gained historical wins over the competition in major retail outlets, Zen 3 will just push that lead further.”

More Stories

EKWB Unveils The Quantum Vector FE RTX 3080 D-RGB – Special Edition Blocks For GeForce RTX 3080 FE Graphics Card

AMD Ryzen 7 5800H 8 Core & 16 Thread Cezanne ‘Zen 3’ High-Performance CPU Shows Up, Early ES Chip With 3.2 GHz Clocks

AMD Ryzen 9 5950X 16 Core Flagship CPU Benchmarked Again, Crushes Intel’s Top Core i9-10980XE 18 Core HEDT Chip