ARM, the British silicon ship designer backed by SoftBank, has long been the subject of speculative interest. Today, that interest has reached a fever pitch amid reports that NVIDIA (NASDAQ:NVDA) is exploring the possibility of acquiring the UK-based chip designer.

According to the reporting by Bloomberg, NVIDIA has approached SoftBank, ARM’s parent company, regarding a possible takeover deal. Nonetheless, as the talks are currently in a preliminary stage, other bidders might emerge as well.

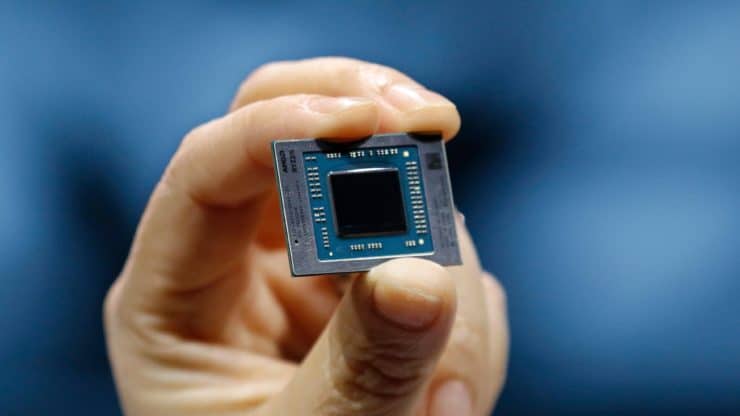

As a refresher, ARM designs silicon chips and licenses instruction sets that govern how chips communicate. SoftBank purchased ARM Holdings in 2016 for $32 billion and hopes to earn a hefty return on its investment by either publicly listing the British chipmaker or selling it to the highest bidder. Moreover, ARM currently holds a 49 percent stake in its Chinese JV, ARM China, with a consortium of investors led by the Chinese equity fund, Hopu Investment, retaining the residual 51 percent stake.

If ARM were to be purchased, it would constitute one of the chip industry’s largest acquisitions. However, any potential deal will not be a walk in the park. Along with the usual hurdles associated with a deal of such magnitude, regulatory glare may prove to be a stumbling block. Finally, ARM’s existing customers may try to block the acquisition or demand assurances regarding equal access to ARM’s technology.

It does make sense for NVIDIA to pursue the takeover of ARM. After all, SoftBank has been a major investor in NVIDIA, having amassed a $4 billion stake in 2017. Nonetheless, SoftBank’s gargantuan $100 billion Vision Fund disclosed in early 2019 that the entirety of its NVIDIA stake had been liquidated.

NVIDIA will benefit from synergies emerging out of its acquisition of ARM should the deal achieve closure. The development would also mark a continuation of the recent acquisition spree by the maker of GPU cards. As a refresher, NVIDIA officially completed its acquisition of Israel’s Mellanox Technologies on the 27th of April, capping an arduous process that spanned over 13 months. Moreover, on the 4th of May, NVIDIA declared that it was buying the open networking software company, Cumulus Networks, for an undisclosed amount. NVIDIA shares have risen by around 76 percent in 2020, allowing the company to briefly eclipse Intel’s market cap a few weeks back. The single most powerful tailwind for NVIDIA shares is the euphoria surrounding the anticipated release of the latest iteration of gaming consoles later this year. Analysts expect this development to unleash a GPU upgrade supercycle. It is also benefiting from the booming demand for data centers and AI applications.

More Stories

EKWB Unveils The Quantum Vector FE RTX 3080 D-RGB – Special Edition Blocks For GeForce RTX 3080 FE Graphics Card

AMD Ryzen 7 5800H 8 Core & 16 Thread Cezanne ‘Zen 3’ High-Performance CPU Shows Up, Early ES Chip With 3.2 GHz Clocks

AMD Ryzen 9 5950X 16 Core Flagship CPU Benchmarked Again, Crushes Intel’s Top Core i9-10980XE 18 Core HEDT Chip